The paycheck (la busta paga)

Everyone that works regularly in Italy and has a subordinate contract (contratto da lavoratore dipendente) receives from the employer at the end of each month a document called busta paga (paycheck). The busta paga shows the salary you must receive for the work you have done.

The busta paga (paycheck) is an important document for a worker. If you have an employee contract, you will receive your monthly paycheck containing useful information about your job and your salary that will help you know your rights.

In the busta paga there is a lot of useful information. Some are easy to understand but others a bit more complicated. That’s why we want to try to help you better understand this information.

What’s the busta paga for?

The busta paga is used to check if the salary is correct, your holidays, refunds and other rights provided by your contract. When you receive your busta paga you can always check this information:

- If the salary you have received corresponds to the one decided in the contract;

- If the number of working hours really corresponds to the hours you worked;

- If the hours for ferie, or holidays (you get paid, but you do not work) that you have used and available are correct.

The busta paga also proves that you have a regular job. It is, therefore, very important in these two cases:

- To rent a house. The owner of the house can ask for busta paga to verify that you work and that you have an income to pay the rent;

- To renew your work permit. The busta paga shows that you are working regularly in Italy and your documents can be renewed.

More generally, you need your busta paga every time you need to prove that you are working.

How to read the busta paga?

It is important to know that there is not only a single busta paga type. Every employer is free to use the type they want. Generally, each busta paga is divided into three main parts:

- The header. With the employer and the worker information.

- The middle part. Here, you find the gross salary and all the deductions. Deductions are that part of your salary that the state takes for taxes and retirement.

Retirement (pensione) is a monthly contribution that you will receive from the state when you no longer work (or are no longer able to work). You are entitled to a retirement contribution if you have worked regularly (and paid taxes) for several years. - The final part. You will find other information such as net salary, holidays, TFR amount, etc.

The net salary (stipendio netto) is what you get from your employer after taxes.

The trattamento di fine rapporto (TFR), also called liquidazione (settlement), is that part of your salary that the employer keeps and then gives back when you finish working for that company.

Let’s take a closer look at the most important information in each of these parts.

The header of the busta paga

In the header of the busta paga you will find this information:

- Employer. Name of the company where you work, codice fiscale (tax number) or partita IVA (VAT number) of the company, address, etc.

- Worker. First name, last name, date of birth, codice fiscale. The date of recruitment (when you started that job), the professional qualification, the job and the level. For example: Impiegato Livello 1 (Employee Level 1).

- Attendance. The month for which you receive the salary (for example February 2020). The number of days and hours you have worked. Working hours are divided into ordinary and extraordinary hours. Ordinary hours are the hours of work usually set by your employment contract: for example 40 hours per week. If you work more, you are working extra hours: for example, if you work 42 hours in a week, 40 hours are ordinary and 2 extraordinary hours.

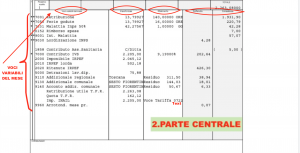

The central part of the busta paga

In the central part of the busta paga you will find the stipendio lordo, or gross salary, with the various information that it is composed of.

The gross salary is the total salary which also includes the taxes that are paid. The employer retains part of your salary to pay taxes to the State and pay social security contributions (contributi previdenziali), that is to pay part of your future retirement (pensione) contribution. So your salary (that you will receive from your employer) will be lower than your gross salary.

The information in this part of the busta paga is divided as follows:

- “Voci variabili del mese” (Variable items of the month): In this first column, you find the description in details of the salary for that month. For example, the salary, the holiday hours that you have taken, if you have taken a few days off during the month, INPS social security contributions, taxes to be paid to the state, TFR amount, etc.

Holidays (ferie) are days off from work. Even if you don’t work, days off are still paid in your busta paga. Everyone who works with a regular contract is entitled to a number of days off. The holidays you have enjoyed (ferie godute) are the number of days/hours of holidays you have taken during the month.

Social security contributions (contributi previdenziali) is the sum of money paid to finance your future pension and other support in the event of illness, accidents at work, maternity, unemployment, etc. to which all workers are entitled.

The Trattamento di Fine Rapporto (TFR) rate is a small amount of money that the employer retains from the salary during the time you work in that company. It is then returned to you when the working relationship with that company ends. - “Importo base” (Basic amount): here, you will find the basic pay (or minimum pay) calculated for your salary. The cost of each work hour is usually established by law and by agreements with national unions.

Read more about employment contracts in Italy. - “Riferimento” (Reference): in this column you will find the hours of work, ordinary and extraordinary if you have worked more, and the days of vacation for that month.

- The last two columns, usually highlighted in a darker color, are called “Trattenute” (Deductions) and “Competenze” (Fees). The first contains the money that is deducted from your salary to pay taxes to the state, and social security contributions to be paid to the INPS. The second one contains the value of all the hours of work done, the holidays you have enjoyed, or other bonuses that are due to you.

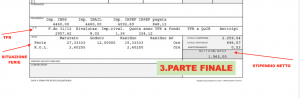

The final part of the busta paga

In the final part of the paycheck, you find the value of the net salary (netto del mese), that is what you have to receive from your employer. Net salary is the difference between the total of your gross salary (column “Competenze”) minus all deductions/taxes (column “Trattenute”).

There is also more detailed information about holidays (ferie) and TFR.

Holidays are days off from work but paid in the busta paga. These hours accumulate every month, the total number of holidays until that month can be found under the item “Maturato” (accrued). The holidays you have taken until that month can be found under the heading “Goduto” (taken). The item “Residuo” (remaining) instead are the holidays you have left, those you still have to take.

The item “Residuo AP” indicates the holiday of the year before that you have not yet used. You will first use the remaining holidays of the previous year, and then those of the current year.

You might be interested in

-

The employment contract

See the article -

Documents for working in Italy

See the article